Expense policy

Where possible all costs incurred by RCSI should be through the purchasing system where an order is placed against the relevant budget code as authorised by the budget holder.

In instances where employees incur expenses related to their work, they must comply with Revenue Commissioner rules.

All expenses must be incurred wholly, exclusively and necessarily on behalf of the College for its business and must be pre-approved by the head of Department and fully supported by original receipts/documentation.

Employee web expense procedure

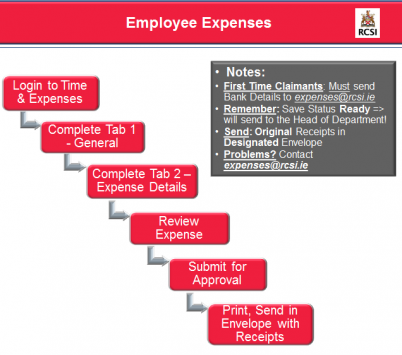

There are a number of steps in the Employee Expense Claim process:

Employee Expenses Steps

For detailed Instructions, please downloaded the How-To Create Expenses document.

Main Points

- Employee Expense Claims should be completed using the Finance Online System.

- First Time Claimants – for reasons of Data Protection compliance, you must submit your bank account details to expenses@rcsi.ie

- Supporting original receipts should then be submitted to Finance department using the designated employee claim envelope for reimbursement within 30 calendar days of return date. If you don’t have the designated envelope, please request it from Finance (expenses@rcsi.ie).

- Expenses received after those dates need to be signed-off by Head of department or appropriate Manager with an explanation for delay. Expenses which are more than 60 calendar days old may be disallowed.

- Reimbursement to claimant will always be made by electronic funds transfer (EFT) directly into your bank account. The College run a payment each week. Your expense claim will be included in the next payment run if the expense has been fully approved and supporting receipts have been provided.

- Each traveller is to submit his or her own Travel Expense Claim form even if travelling with one or more College faculty or staff members. The preferred method of reporting is for each traveller to report only his/her expenses. If several College employees are travelling together and an expense is combined (such as accommodation costs, meals, etc.) the cost must be clearly documented on the online travel expense claim of the individual claiming the combined amount. The documentation should include the names of the other College employees involved

If you require further assistance please contact (expenses@rcsi.ie Phone: 01 402 2361).