I am a new employee with RCSI, how do I avoid emergency tax?

Ensure that RCSI is registered as your new employer via the Revenue MyAccounts portal. RCSI will register your employment with Revenue for you approx one week before payday however, if this is your first job in Ireland, you may need to register with Revenue yourself.

Click on Manage your tax and select “Add Job”.

Revenue will look for RCSI Company Registration Number – 0051194E

You can also contact revenue on 1890 333 425 or 017383636 to get your tax credits allocated against your new employer, please note you will need your PPS Number when calling Revenue. Once revenue have allocated your tax credits to RCSI an amended tax certificate will issue to you and RCSI.

What is a Tax Credit and USC certificate?

Your tax credit certificate is a document declaring which tax credits are being used to reduce the amount of tax you have to pay.

Each employee must ensure their tax credit certificate and details recorded on their payslip are correct

The RCSI Payroll department receives totals of your tax credits, tax rate bands, USC rate bands and LPT electronically from Revenue for each employee registered with Revenue.

The onus is on each employee to ensure that their tax credit certificate details are up to date and correct. Any queries pertaining to tax credit certificate must be raised directly by the employee with Revenue on 01 7383636.

Universal Social Charge (USC) is also shown on your tax credit certificate. For information on USC please see Revenue Website

When are RCSI staff paid?

RCSI payday is the 25th of each month (for the full month). Where the 25th falls on a weekend, we will bring payday forward to the Friday before hand. If the 25th falls on a Monday, you will be paid on Monday.

When does payroll close?

The cut-off for submission of all pay related documentation including timesheets and changes of personal information i.e. new bank account details, is the 5th day of each month.

How do I access my payslips online?

Payslips are visible through the Core HR Portal. You will need to use your PC login to access your payslips.

I can’t access my Payslips?

If you are having difficulty logging in, you may need your system password reset. Use the Password Reset steps. If you are still having difficulty, please contact helpdeskRCSI@rcsi.com for assistance in password reset.

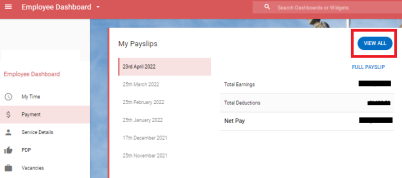

I can only see the latest 4 payslips online?

Click on the View All button to see your historic payslips

Why does my salary change month-on-month as I take the same number of days parental leave each month?

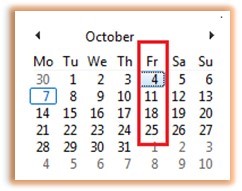

The unpaid parental leave day in the month can cause a fluctuation month-on month on your salary. Some months have 5 Mondays or 5 Fridays whereas other months have just 4 Mondays or 4 Fridays. For example, if you take Friday as an unpaid parental leave day in October, you will see a deduction on your October payroll of 4 days. If you continue to take Fridays as an unpaid parental leave day in November, you will have 5 days unpaid in November as there are 5 Fridays in November. Please check the calendar and count the number of days you were on leave for the month in question.

How do I change my bank account or address?

This is done through the Core HR Portal by selecting My Profile on the top right and then Bank Details on the left. Ensure the IBAN and BIC are accurate before saving. The IBAN and BIC must be entered and not left blank.

Will I get a P45 when I cease employment in RCSI?

From 1st of January 2019, a form P45 at cessation is no longer issued by the employer to the employee. Instead, a submission to Revenue is completed on payday outlining the full and final gross and tax details along with a cessation date. You can obtain a statement from Revenue confirming this data by logging into your personal Revenue MyAccounts page.

Where is my P60?

From 1st of January 2019, P60s are no longer issued by the employer to employees. P60s are abolished upon the introduction of PAYE Modernisation as the full years gross and taxes are reported to Revenue in real time on the day you are paid. You can download a statement from the personal Revenue MyAccounts page which you can use to do a tax return or apply for a bank loan. P60s for prior years, 2018, 2017, 2016 etc. are available on the Core HR Portal. If you are unable to obtain these documents, please email payroll@rcsi.ie quoting your staff number or your PPS number.

I need a summary of my pay and statutory deductions which is required to apply for a mortgage.

RCSI staff can obtain a summary of their pay and tax details from Revenue via myAccount. Under the PAYE Services card in myAccount, you can click on the “Create a summary of your pay and tax details”.

I need a Salary Certificate completed as I am applying for a mortgage.

Please request a Salary Certificate

Is Maternity benefit taxable?

Maternity Benefit (Payment from the Department of Social Protection) is taxable since 01 July 2013 for all claimants. Universal Social Charge will not be payable. Tax is collected on the maternity benefit by way of Revenue reducing your tax credits. This reduction in tax credits is communicated by Revenue directly to RCSI to operate on payroll.

What are the tax rates?

To better understand PAYE, USC and PRSI, Tax rates are available to review here.

My gross is the same but my net pay changed?

1. If your gross pay is the same but your net pay is different, the reason is more than likely due to a change in tax.

This is due to a change in your tax status. This information is received by RCSI from Revenue and you can view the differences and make changes to your tax details via Revenue’s MyAccounts portal. Compare your tax credits last month to the current month to see if Revenue changed your tax credits.

Generally you will see a change in your tax credit information in January at the start of each tax year.

2. Another reason for a tax change is that you may have had no income for a portion of the current tax year meaning you may have a build-up of unused tax credits. These unused tax credits are then applied the current months pay to reduce your tax liability. When you have utilised your unused tax credits, your taxes and net pay then normalises and will remain static.

How do I start or increase my AVC (Additional Voluntary Contribution)?

The application is completed online here. This form will be sent to HR, Payroll and the pension provider Willis Towers Watson. Please indicate if you want to apply an amount or a percentage. (no need to indicate both).

How is my net pay affected by contributed to an AVC

If you are a high earner (generally more than €35,500 per year) then multiple the value you want to put into your AVC and multiple that by 0.6. The result is the amount that your net pay will be reduced by. E.g. If you want to put in €200 AVC per month, your net pay will decrease by €120. (€200 x 0.6 = €120).

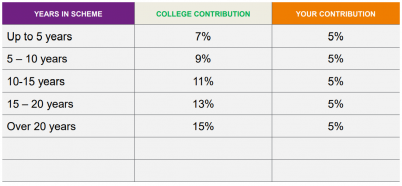

What percentage of my salary is being paid to my pension?

The employee portion is 5%. The employer portion depends on the number of unbroken years you have been part of the pension scheme.

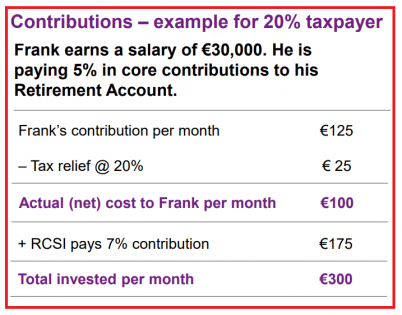

How much net does it cost me to pay into a pension?

Example 1. Frank is an earner whos tax liability is on the lower tax rate. Below shows that Frank is paying €125 into his pension. The net pay decreased €100 and the amount being paid into his pension fund by him and RCSI is €300.

Example 2. Eileen is a high earner and taxed at the 40% bracket. She is paying €250 into her pension meaning her net pay is decreased €150. The amount being paid into her pension fund by her and RCSI is €600.

What is ER PENSION on my payslip?

The NDC Pension Scheme is the amount of pension that you pay into your pension. The ER Pension is the amount RCSI pays into your pension for you. The ER Pension is on your payslip for reference only and does not affect your salary.

How much have I paid into my Pension and how much is it now worth?

View your pension contributions, values and other information on the Willis Towers Watson web portal here. You can contact them for your account number by emailing DCadmin1.irl@willistowerswatson.com

If I change my hours or gross pay, how will my net pay change?

Try the PwC payroll online pay calculator, which can be found here.

How does the tax saver and cycle to work affect my net pay?

The tax saver website outlines how much the actual cost of a travel ticket is to you. Try and enter the full price of the ticket and see how much you can save. Click here. The same method of calculation is done for cycle to work. Full details on how to apply can be found here.

How can I contact the Payroll Department?

For any payroll related queries, please contact payroll@rcsi.ie

Please have your RCSI staff ID or PPS number to assist us in locating your pay profile.